Let's Talk About Your Needs

Subscribe Now! Get Awesome Monthly Posts

Make your business more successful with latest tips and updates for technologies

AI \ Use Cases \ AI Use Cases in BFSI

Transforming investment management with AI-driven Predictive Analytics. Leveraging advanced algorithms, our AI solutions for banking sector analyzes historical market data, identifies trends, and predicts potential investment opportunities. Real-time data processing enables instant risk assessment, optimizing portfolio management. The AI model adapts to market dynamics, enhancing accuracy in forecasting market movements. Further, the solution empowers financial institutions to make informed investment decisions, maximizing returns and mitigating risks. Unparalleled predictive analytics to seamlessly integrate with existing systems, providing a competitive edge in the ever-evolving financial landscape. Futurism’s AI solution transforms investment strategies, ensuring strategic decision-making for sustainable financial growth.

Futurism leverages AI for Robotic Process Automation (RPA) to streamline document processing. The system employs natural language processing to extract and analyze information from unstructured data, such as financial documents and forms. AI algorithms enable intelligent decision-making, automating routine tasks like data entry, verification, and compliance checks. This not only reduces operational costs but enhances accuracy and compliance. The AI-driven RPA solution ensures swift processing of loan applications, improves fraud detection, and accelerates customer onboarding. Futurism’s AI-driven RPA optimizes workflows, ensuring the BFSI sector achieves higher efficiency, improved customer experience, and increased agility in adapting to evolving industry regulations.

Utilizing AI for dynamic security protocol adaptation and predictive fraud prevention. Futurism Technologies can integrate AI systems that not only detect current fraudulent activities but also predict and adapt to future threats through continuous learning algorithms. This proactive stance on cybersecurity leverages data from global cyber threat patterns, enhancing the banking sector’s ability to preemptively secure its digital assets and customer data. AI continuously monitors and analyzes data patterns, swiftly identifying anomalies indicative of potential cyber threats. In real-time, the system triggers automated responses or alerts security teams for immediate action. Machine learning enhances threat detection accuracy over time, adapting to evolving risks. AI also fortifies authentication processes, implementing biometric recognition and behavior analysis for user verification. This proactive approach ensures the confidentiality and integrity of sensitive financial data, safeguarding against cyber threats prevalent in the dynamic landscape of the Banking, Financial Services, and Insurance (BFSI) sector.

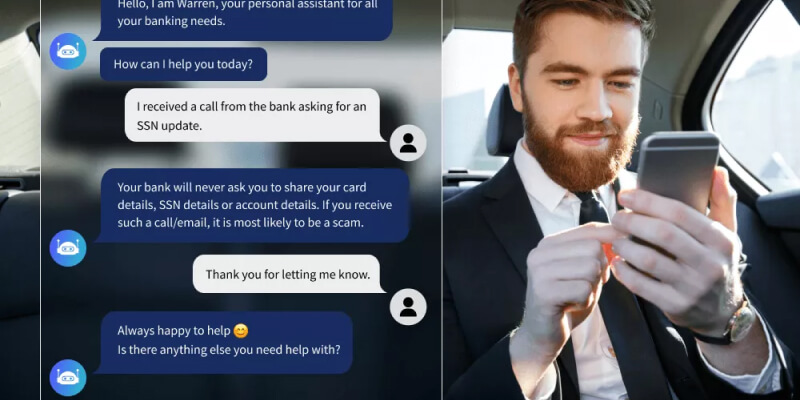

Deploying AI-driven chatbots for personalized financial advice and support. Beyond handling routine inquiries, Futurism’s advanced chatbots can analyze individual customer data to provide tailored advice on savings, investments, and financial planning. These chatbots can simulate a personal financial advisor, offering insights based on the customer’s financial behavior, preferences, and goals, thus elevating the customer service experience to new heights.

Enhancing loan and credit decisioning with AI to include non-traditional data points. Futurism Technologies can develop AI models that go beyond credit scores and history, incorporating alternative data such as utility payments, rental history, and even social media activity to assess creditworthiness. This inclusive approach can expand financial services access to underserved markets, improving financial inclusion and opening new customer segments for BFSI institutions.

Automating regulatory compliance and risk management with AI. Futurism Technologies can enhance its AI offerings to include automated tracking and analysis of regulatory changes, ensuring that financial institutions remain compliant with minimal manual oversight. Additionally, AI can be used to model various risk scenarios, helping banks and financial institutions to manage and mitigate risks more effectively.

Utilizing advanced machine learning algorithms, the system constantly analyzes vast datasets of financial transactions in real-time. It identifies unusual patterns, anomalies, and potential threats, flagging them for immediate investigation. AI continuously evolves through self-learning, adapting to new fraud tactics and improving detection accuracy. This proactive approach ensures swift response to emerging threats, safeguarding financial institutions and their clients from fraudulent activities. With AI-driven fraud detection, Futurism’s AI solution for BFSI enhances security, minimizes financial losses, and establishes a robust defense mechanism against evolving threats in the dynamic landscape of the Banking, Financial Services, and Insurance (BFSI) sector.

Futurism Technologies employs AI Digital Marketing in BFSI to revolutionize customer engagement. By leveraging advanced algorithms, the system analyzes vast datasets to identify personalized financial preferences and behaviors. This enables targeted content delivery, enhancing customer interactions and driving lead conversions. AI optimizes ad placements, tailors marketing campaigns, and predicts market trends, ensuring a competitive edge. Real-time data analysis allows for immediate adjustments, maximizing ROI. With Futurism’s AI Digital Marketing, BFSI institutions can cultivate customer trust, deliver relevant services, and stay ahead in an ever-evolving financial landscape.

AI-powered digital marketing strategies for hyper-personalized customer engagement. By analyzing customer data, Futurism’s AI-driven digital marketing solutions can craft personalized marketing messages and offers, delivered through the customer’s preferred channels at the optimal time. This approach not only increases engagement and conversion rates but also strengthens customer loyalty and brand affinity.

Expanding the use of Generative AI to create highly personalized banking experiences and innovative financial products. Futurism Technologies can harness the power of Generative AI to develop new financial products and services that are highly customized to individual customer needs, driving innovation and differentiation in the BFSI sector.